In-Person Credit

Counselling

Come face to face with the Credit Counsellor & Clear your doubts..

Mr. Satyanarayan Jaiswal, The Founder of “The Udyam Bandhu Institution” , is a SIDBI Certified Credit Counsellor (CCC) for MSMEs and plans to Scale up Udyam Bandhu into a premier Credit Counselling Institution(CCI) in coming days, and currently Credit Counselling Services to Enterprises for both within & beyond is being provided by him within the ambit & scope of work of CCCs as envisaged by SIDBI.

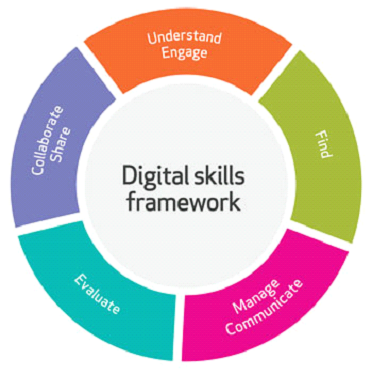

In order to kindle market mechanism no specific operational jurisdiction is envisaged & Fee Based ONLINE Application filling by Hand Holding in a Virtual Environment, including Tele Counselling & E- Counselling services available.

For More Details email : info@udyambandu.com

Disclaimer :We DO NOT ASSURE to provide Credit, as Credit underwriting is purely a ‘commercial’ decision of the Banks / Financial Institution concerned .

A Brief History of Regulated Credit Counsellors/Intermediaries in India :The Deepak Mohanty Committee, a committee constituted by Government of India (GoI) to study on medium term path on financial inclusion, in its report of December 2015, had recommended as under: “The Committee recommends exploring a system of professional credit intermediaries / advisors for MSMEs, which could help bridge the information gap and thereby help banks to make better credit decisions. The credit intermediaries / advisors could function in a transparent manner for a fee and be regulated by the Reserve Bank.”

According, in the first Bi-Monthly Monetary Policy Statement for FY 2016-17 on April 05, 2016 an announcement was made by Dr. Raghuram G. Rajan, the then Governor as follows: “The Reserve Bank will lay down a framework by September 2016 for accreditation of credit counsellors who can act as facilitators for entrepreneurs to access the formal financial system with greater ease and flexibility. Credit counsellors will also assist MSMEs in preparing project reports in a professional manner which would, in turn, help banks make more informed credit decisions.”

Accordingly, Small Industries Development Bank of India (SIDBI) a RBI subsidiary was entrusted with the responsibility to Act as a Implementing and Registering Authority(IRA) for the purpose of implementation of the RBI framework by Evaluating, Registering, Regulating & Certifying the eligible Credit Intermediaries/Counsellors for assistance to MSMEs. Henceforth, the Successful Eligible Individual Credit Intermediaries/Counsellors in India became registered Certified Credit Counsellors (CCC) with SIDBI to assist MSMEs.

Certified Credit Counsellor (CCC): Refers to a credit counsellor as an individual or a representative of a Credit Counselling Institution acting as a credit counsellor, who is certified by the certification agency, and for a consideration, will act as a facilitator for micro, small, medium enterprises and / or potential entrepreneurs in the micro, small or medium sector to access the formal financial system in India with greater ease and flexibility.